Selling real estate in Michigan can be emotionally and legally complex—especially when it’s tied up in a divorce or inherited through probate.

These aren’t just financial transactions; they’re life transitions that come with both legal obligations and personal emotions.

Whether you’re dividing assets after a separation or managing a loved one’s estate, understanding the process can help you avoid costly missteps.

This guide walks you through what to expect and how to navigate the rules around property sales involving Michigan real estate divorce or inheritance.

Understanding Divorce-Related Property Sales in Michigan

Marital vs. Separate Property

Michigan is an equitable distribution state, which means marital assets are divided fairly, not necessarily equally.

Generally, according to Michigan divorce laws regarding property, anything acquired during the marriage—including the marital home—is considered marital property.

However, assets owned before marriage, or received individually through gift or inheritance, are typically deemed separate property unless they’ve been mixed (or “commingled”) with marital assets.

When a couple divorces, determining what’s marital versus separate is the first major step in figuring out whether the home will be sold or transferred.

The Divorce Judgment

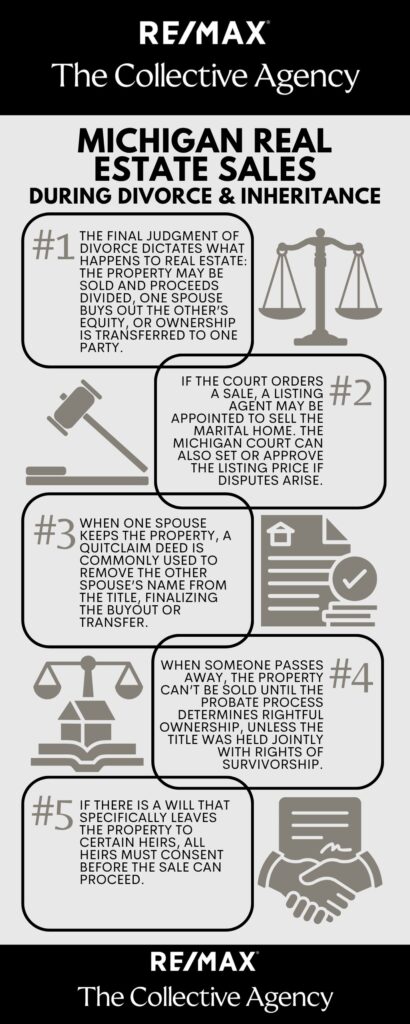

The final Judgment of Divorce dictates what happens to real estate. It may order that:

- The property be sold and proceeds divided,

- One spouse buys out the other’s equity, or

- Ownership transfers entirely to one party.

The court’s decision often considers factors like child custody, financial contributions, and each party’s ability to afford the home post-divorce.

Court Orders to Sell

If the court orders a sale, the process follows a set path.

A listing agent may be appointed, either by agreement or court directive, when selling a marital home. The Michigan court can even set or approve the listing price if disputes arise.

Once sold, the net proceeds (after mortgage payoff and costs) are distributed per the court’s judgment.

Quitclaim Deeds

When one spouse keeps the property, a Quitclaim Deed is commonly used to remove the other spouse’s name from the title. This document transfers ownership without warranties, finalizing the buyout or transfer specified in the divorce decree.

However, it’s crucial to note that signing a quitclaim deed does not remove the departing spouse from the mortgage—refinancing is often required for that.

Understanding Inheritance-Related Property Sales in Michigan

The Role of Probate

When someone passes away owning real estate in Michigan, the property usually can’t be sold until the probate process determines rightful ownership—unless the title was held jointly with rights of survivorship.

Probate ensures debts are settled and assets are distributed according to the will (or state law if there’s no will).

If the property was solely in the decedent’s name, it becomes part of the probate estate and can only be sold by the appointed Personal Representative (sometimes called the executor).

The Personal Representative’s Authority

The Personal Representative receives Letters of Authority from the probate court, granting them the legal power to act on behalf of the estate. This includes signing listing agreements, purchase contracts, and closing documents.

Without this court-issued document, no sale can legally occur.

Heir Consent

If the will specifically leaves the property to certain heirs (instead of instructing it to be sold), all heirs typically must consent before the sale can proceed.

In the absence of a clear direction, Michigan courts may require a written agreement among heirs to avoid disputes later.

Determining the Capital Gains Basis

Heirs benefit from what’s known as a stepped-up basis, meaning the property’s value is reset to its fair market value as of the date of death.

This is why getting a Date of Death Appraisal is crucial—it establishes the property’s tax basis for any future sale. Often, this means heirs owe little to no capital gains tax when selling soon after inheriting.

Financial and Tax Considerations

Mortgages and Liens

Any outstanding mortgage or lien (such as a tax lien or judgment) must be paid off at closing. In divorce cases, the divorce judgment specifies how the payoff is handled. In probate sales, the estate typically pays these debts before distributing proceeds to heirs.

Transfer and Recording Fees

In Michigan, transferring property ownership incurs state and county transfer taxes—$7.50 per $1,000 of sale price for the state tax, and $1.10 per $1,000 for the county tax (rates may vary slightly by location).

You’ll also pay a recording fee, usually around $30, when the new deed is filed.

Tax Implications of Divorce Sales

If the property was your primary residence for at least two of the last five years, up to $250,000 of gain per person (or $500,000 for married couples) can be excluded from federal capital gains taxes—even if the sale happens during or shortly after a divorce.

Tax Implications of Inheritance Sales

Inherited property is treated more favorably. Because of the stepped-up basis rule, most heirs owe little to no capital gains tax if they sell near the appraised date-of-death value.

Key Legal and Logistical Steps for Listing the Property

Securing Legal Counsel

Before listing, it’s essential to work with an attorney familiar with your situation.

A Family Law Attorney handles divorce-related sales, ensuring compliance with the Judgment of Divorce.

A Probate Attorney helps the Personal Representative navigate court timelines and approvals.

Choosing a Real Estate Agent

Not all agents are equipped to handle court-involved sales. Look for a Realtor experienced in divorce and estate transactions who understands coordination with attorneys, judges, and title companies under strict deadlines.

Property Preparation and Disclosure

In divorce cases, one party may still be living in the home, making cooperation key. In inherited sales, homes are often vacant or need cleanup and estate liquidation. Michigan sellers must disclose all known material defects—even in as-is sales—to avoid liability.

Court Confirmation (If Applicable)

In some probate cases, especially if there’s no will or if heirs object to a sale, the Probate Court may need to approve the final offer. This ensures transparency and protects heirs’ interests.

Frequently Asked Questions

Can a Michigan judge force me to sell my house in a divorce?

Yes. If the court determines that selling is the fairest option, it can order the home’s sale and dictate how proceeds are divided.

Do I need to hire a separate attorney for the sale of inherited property if the estate already has a Personal Representative?

Usually not. The Personal Representative’s attorney can handle the sale, but consulting your own lawyer is wise if you have personal concerns or disputes.

What is the quickest way to sell inherited property in Michigan without going through full probate?

If the estate qualifies as a small estate (under Michigan’s threshold, currently $27,000+ in personal property value), you may avoid full probate using simplified procedures.

How long do I have to wait after a divorce is final to refinance or sell the home?

Once the Judgment of Divorce is entered and any required deeds are signed, you can refinance or sell immediately—unless restricted by the court order.

What happens if the heirs or ex-spouses cannot agree on the listing price of the property?

The court can intervene. In probate, the judge may approve a fair market offer. In a divorce, the court may appoint a Realtor to determine a listing price.

Can a Personal Representative sell inherited property to themselves or another heir?

Yes, but only with full disclosure and typically court approval, to ensure the sale is fair to all beneficiaries.

In a Michigan divorce, is the property’s value based on the date of separation or the date of sale?

Usually, the court values property near the time of trial or settlement—not the date of separation—unless both parties agree otherwise.

Key Takeaway

Legal compliance is paramount. Selling property during divorce or inheritance in Michigan requires strict adherence to court orders and probate rules.

The core distinction lies in authority: divorce-related sales follow the Judgment of Divorce, while inherited property sales follow the Letters of Authority issued by the Probate Court.

Partnering with an experienced attorney and realtor ensures that every step—from listing to closing—stays compliant, transparent, and as stress-free as possible.

Have questions about this guide? Feel free to give us a call at 248-780-0942 for inquiries or to schedule an appointment with our team.

Additional Resource:

For more insights on estate and financial planning, check out this helpful video: