Inheriting a property in Michigan is one of those life moments that feels both weighty and personal.

Whether it’s your childhood home, a vacation cottage up north, or a rental your parents once managed, the process brings a mix of emotions — nostalgia, gratitude, and, sometimes, confusion about what happens next.

In Michigan, transferring ownership of inherited property is not automatic. There are important legal and financial steps that must be followed to ensure the transition goes smoothly.

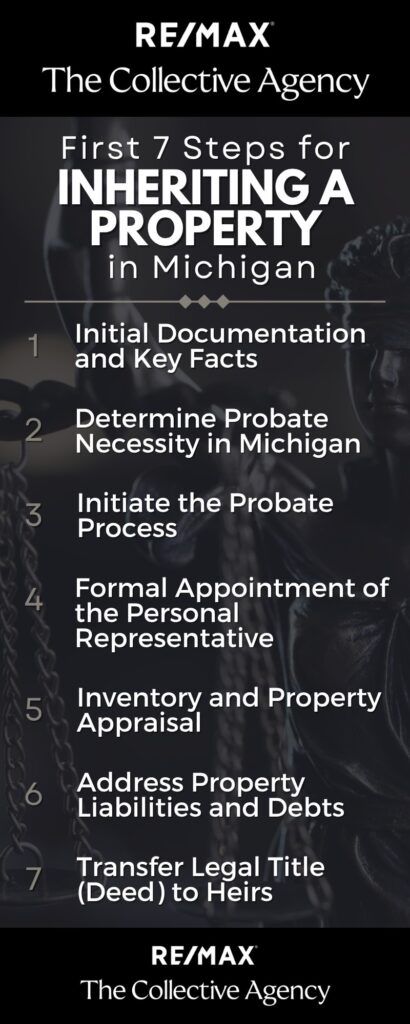

Let’s break down the first seven steps every heir should take when inheriting real estate in the Great Lakes State.

1. Initial Documentation and Key Facts

The first order of business is getting the paperwork in order. It may not be the most emotional part of the process, but it’s the foundation for everything that follows.

Obtain the Death Certificate

Start by securing certified copies of the official death certificate. You’ll need them to prove death to banks, insurance companies, the probate court, and title companies.

Most Michigan counties issue these through the local clerk or health department. It’s smart to request several copies (usually five to ten).

Locate the Will or Trust

Next, determine if the deceased left a Last Will and Testament or if assets were placed in a revocable living trust.

A Will typically must go through probate to be validated, whereas assets held in a trust usually bypass probate altogether.

Identify the Personal Representative (Executor)

The Will should name an Executor, or if none is listed, the court will appoint a Personal Representative.

This person manages the estate — paying bills, handling assets, and distributing property according to the Will or, if there isn’t one, according to Michigan’s intestate succession laws.

2. Determine Probate Necessity in Michigan

When inheriting property, not all goes through probate. Whether it does depends largely on how the property was titled and the overall value of the estate.

Review Property Ownership

Inheriting a house in Michigan involves checking the deed to see how the property was owned. If it was held in joint tenancy with rights of survivorship, the surviving owner typically becomes the sole owner automatically.

Michigan also recognizes the enhanced life-estate deed, often called a Lady Bird Deed, which allows property to pass directly to designated beneficiaries upon death without going through probate. Property held in a trust also avoids probate.

Assess Estate Value

If the estate does require probate, determine which type applies. Michigan offers several probate options:

- Formal Probate: Used for complex estates or when disputes may arise.

- Informal Probate: The most common route for straightforward cases.

- Small Estate Process: For estates below a certain value limit.

Small Estate Exception

Under MCL §700.3982, smaller estates can qualify for a simplified process called Transfer by Affidavit or Petition for Assignment.

The dollar threshold for this process changes periodically (around $51,000 in recent years), so it’s best to confirm the current limit with your local probate court or attorney before proceeding.

3. Initiate the Probate Process

If the Michigan probate process is required, you’ll need to file a petition with the probate court in the county where the decedent lived — for example, Wayne, Oakland, or Macomb County.

Typically, this involves submitting a Petition for Probate and/or Appointment of Personal Representative. Once accepted, the court officially opens the estate.

Notification of Interested Parties

Michigan law requires that all heirs, beneficiaries, and interested parties be formally notified that the estate is open.

This ensures transparency and gives everyone an opportunity to object or present claims before assets are distributed.

4. Formal Appointment of the Personal Representative

After the court reviews the petition, it issues an order appointing the Personal Representative (Executor).

Once appointed, the court provides Letters of Authority, the document granting the representative legal power to act on behalf of the estate.

Wit these Letters, the representative can access bank accounts, pay bills, sell property, and manage other estate affairs in accordance with Michigan law.

Maintaining accurate records is essential — every transaction related to the estate may be subject to court oversight or final accounting review before closure.

5. Inventory and Property Appraisal

The next step is creating a complete inventory of the estate’s assets. For real estate, this includes the property’s legal description, address, and condition.

Hire a professional appraiser to establish the property’s fair market value as of the date of death. This valuation is crucial for two reasons:

- It helps determine the estate’s total worth for probate purposes.

- It sets the cost basis for future capital-gains tax calculations.

When the property is eventually sold, the gain or loss is based on the difference between the sale price and this “stepped-up” date-of-death value. A precise appraisal helps avoid unnecessary tax complications later.

6. Address Property Liabilities and Debts

Before a real estate property in Michigan can be transferred, all estate debts must be reviewed and settled.

Review Encumbrances

Check whether there are any mortgages, home-equity loans, tax liens, or judgments attached to the property. If you’re unsure, a title company can run a full title search.

Creditor Claims

Michigan probate law requires the Personal Representative to publish a notice to creditors and give them a specific window — typically four months — to file claims against the estate.

Property Taxes and Insurance

Keep all property taxes, homeowners’ insurance, and utilities current while probate is pending. Lapsed insurance can leave the estate exposed if damage occurs before transfer.

7. Transfer Legal Title (Deed) to Heirs

Once debts are settled and the court approves distribution, it’s time to officially transfer ownership.

Execute the Deed

The Personal Representative signs a Personal Representative’s Deed, transferring the property from the estate to the heirs or beneficiaries as stated in the Will or per Michigan intestacy law.

Record the New Deed

The new deed must be signed, notarized, and recorded with the county Register of Deeds where the property is located (for example, Oakland, Kent, or Ingham County).

Recording updates to public ownership records and completing the legal transfer. Check the county’s website for current recording fees and formatting requirements.

Frequently Asked Questions

How long does the probate process take in Michigan?

Most straightforward estates settle in about 6 to 12 months, though complex or contested cases can take longer.

Do I have to pay Michigan inheritance tax?

No. Michigan’s inheritance tax was repealed for deaths occurring after September 30, 1993. Only very old estates (before that date) or large estates subject to federal estate tax could owe tax.

If the house has a mortgage, am I required to assume the payments?

Yes — the heir or the estate remains responsible for the loan unless the home is sold or refinanced. Federal law generally allows heirs to assume the existing mortgage.

Can I sell the inherited property before probate is closed?

Only with court authorization. The Personal Representative may sell estate property, but proceeds must stay within the estate until final settlement.

What happens if there’s no Will (intestate)?

If the decedent died without a Will, Michigan’s intestacy laws decide who inherits — typically the surviving spouse and children, followed by parents and siblings.

Does Michigan offer any property tax relief for heirs?

While there’s no inheritance-specific exemption, the Principal Residence Exemption (PRE) and Homestead Property Tax Credit may continue for surviving spouses or qualifying dependents who occupy the property. Check with your local assessor’s office.

Key Takeaway

Inheriting property in Michigan is not just about receiving a home — it’s about navigating a structured legal process that protects everyone’s interests.

From verifying documents and confirming probate requirements to settling debts and recording the new deed, each step plays a role in securing clear title.

The good news? Michigan’s probate process, while detailed, is designed to ensure fairness and clarity.

With the right documentation, some patience, and guidance from a qualified attorney or real-estate professional, heirs can complete the transfer confidently — honoring their loved one’s legacy and securing their own future in the process.

Have questions about this guide? Feel free to give us a call at 248-780-0942.

Additional Resource:

For more insights on estate and financial planning, check out this helpful video: